Sunday, August 16, 2009

Can you live in 90% of your salary?

Wednesday, July 29, 2009

A lesson in Trading ADX…

Today I'm going to discuss how we can take help of ADX to trade. Firstly let us understand what ADX means and what it indicates. This indicator has been created by Welles Wilder and he had created this to measure the actual strength of the market whether bullish or bearish. I will not go into the calculations as to how ADX is calculated and plotted and unnecessary complicated our life. Well ADX is not an oscillator in the real sense. It does not move about mean line like perhaps the slow stochastic and MACD or RSI. It is generally plotted as three lines. The first one being black and that indicates the strength of the move. For example if the market is trending up and this black line is also going up it indicates that the uptrend is strong. I'll come to exact facts and figures a little later.

Apart form this there are two additional lines the +DI and the –DI. The +DI lines is also called the Positive Directional Index and the –DI lines is also called the Negative directional index line. Also the +DI is generally green in colour and the –DI line is generally red in colour. If the Black or the ADX indicates the strength or weakness then the +DI and –DI indicate the sellers having the upper hand or the buyers having the upper hand or vice versa. Or let me put it this way

- The +DI line represents how strong or weak the uptrend in the market is.

- The –DI line represents how strong or weak the downtrend in the market is.

- As the ADX (Black Line) is comprised of both the +DI and –DI lines, it does not indicate whether the trend is up or down, but simply the strength of the overall trend of the market.

Before I move forward I would once again repeat that as explained above the ADX line is non directional, it does not tell you whether the market is in an uptrend or down trend – but as to how strong or weak the trend in the stock or index you are analysing is. If you have understood this part then also know that generally when the ADX line is above 40 and rising – this is indicative of a strong trend and if ADX line is below 20 and falling this is indicative of a ranging market. These figures are for reference only and some people tend to use the 25 and 35 figures for the range bound market and trending market respectively. So I suggest you pick up default values and live with them.

So far so good? Now we will try to see how it can be traded. The ADX can be traded in three ways. Pardon my saying that I might like to put it this way that I will not try to trade ADX in all three way but in first scenario I will trade it and in the other two scenarios I will trade a trend or a non trend for that matter.

- Firstly, and most importantly we trade the +DI and / –DI crossovers. Let me put it more simply.

If we have the +DI (the green line) cross over above the –DI (the red line) then I buy. If the –DI line crosses over the +DI line then I sell. I also see this with respect to the ADX line – that is to say if during these crossovers the ADX (the black line) is below the 20 mark then the market is not trending and this could be a misinterpretation of the signal.

how ever if in the same circumstances the ADX line was above 20 and climbing – then it could indicate that you have caught the trend correctly and you may be able to ride it well.

- Like I said before the second and the third are trading the trend or lack of trend. So let us see. If there is a lack of trend then we would like to see the the range of the markets in which they are caught up. In this case it is best that we take help of some other indicator. Bollinger Bands are good indicators when the markets are not trending.

So generally the range of the market would be between the bands – so it may be safe to sell naked options – calls when the markets are around the top of the band and sell puts when around the bottom of the Bollinger bands. The stop loss can be a point just outside the band with the ADX crossing above – say 30! Actually this point has to chosen by you and you alone. My figures are a suggestions only.

- The third is Trading weakness in trend. It is different from a range bound market. Weakness in trend may be taken on an anticipation of trend reversal. So partly buying when the down trend is weakening followed by entering with conviction when the +DI crossover above –DI may be a good strategy.

Along with this we can use the ADX for entry and exit also. Let us assume that you entered the stock when the +DI crossed above the –DI and the trend is gaining strength (ADX moving above 20/25) we would have entered. Now if +DI crosses and goes above the ADX line reinforces the decision taken. ADX moving below 40 may mean a pullback from the trend.

I did not have too much time as my commitments during this leave are keeping me busy so I have used only a few charts for examples – so please pardon me for that.

Also it is very important to remember that ADX or for that any technical indicator must be used in conjunction with some other indicator to reinforce and should not be made use of singularly to take decisions. Please feel free to leave comments – will try to answer if there are queries.

Trading RSI

I had a query raised by vasanihitesh on http://stockezy.com/opinions/2416/The-Noises--Update-for-08-May-09/ . Since I seem to have some time on my hands I will attempt to answer the question as well as I possibly can. The query was “Can we get buy/sell ideas from RSI data..?”

The indicator indicates accomplishes this through a formula that compares – basically the size of recent gains for a particular stock or financial instrument to the size of the recent losses. The results thus plotted fluctuate between 0 and 100. There are bands placed on the upper end above 70 and on the lower band below 30 that are related to extreme overbought and oversold conditions.

There are three ways how the RSI is used to trade on the markets. At this point please do remember that no one indication can tell you exactly how and when to trade. All indicators are to be taken with other indications and the markets themselves.

The first way the RSI is used to trade is seeing extreme over bought or over sold zones. I have inserted an example of ICICI bank behaviour in this march. It was in oversold territory this march and then the recovery started. The recovery has been pretty smart till now. If you now observe the ICICI bank is flirting with the overbought territory and it would be interesting to see how the next few days/weeks pan out.

The second way the Indicator is used for trading is Centreline crossover. That means that when the markets cross the centreline the positions are built – either bearish or bullish depending upon the direction of the crossover. In the example you see that as the RSI crosses over from below the 50 marker to above it – the stocks takes cue and then goes higher. This crossover happened in the third week of March for L&T.

The Third manner in which the RSI is used for trading is Trading RSI Divergences. Hey I have been shouting Divergence on our charts for quite some time if you have noticed. The divergence means that the Markets are making new highs and the RSI is not making new highs or Markets are making new lows and the RSI is not making new lows. I will give and example of this that I have given before – see the Nifty. It made new highs in Jan last year and the RSI was not moving in consonance with the markets – let us say in other words The RSI was not sharing the enthusiasm of the markets. That led to a fall. And very sharp one that is.

I would end now by trying to rub in the fact that no single indication can give you an indication and you can trade it. You have to perhaps take multitude of factors and keep them in the mind before you can trade. Out of the three conditions we have two of them in front of us at this very moment and it would be nice to test our trading by RSI.

Hope that this effort of mine will make someone of you a millionaire.

Cheers !!

Art of buying options…

Hi I am back with sharing my thoughts with options. Like I mentioned before there were queries and suggestions regarding options – why this and why not this. Many of those questions asked were pretty basic. Basic is just one reason. The reasons and the conclusion I came to why those queries had cropped up were

- Options are not traded/treated in India as there are abroad – especially in the US and European markets where LEAPS are offered, the volumes are much higher and options are by and large more liquid.

- We have a mental block – I have been quoting this quote so many times - “A man will spend 1000/- Rs more on something that is useful… A women will spend Rs 100/- less on something that is totally useless.” Unfortunately when we think of buying options we men folk become women. (special apologies to ladies who will read this)

- We think cheap – I will clarify it in the subsequent paragraphs.

Why would we want to buy options in the first place? Well it can be because of any of the following three reasons: -

- Speculation – that involves making directional call on a underlying security or Index. This – I believe is the most popular category that is one on everybody’s mind – bloody gamblers we are!! Including me ofcourse.

- Hedging – Logically this is the idea behind having this instrument in the first place. It is to protect an investment already in place.

- Income producing – generating a cash flow.

I will tackle the first part only today – the most common desire to enter options ‘the speculation’. Let me help you recapitulate:-

- We had earlier seen (in previous article) that the options have a real value and a premium.

- We had also seen that DITM (Deep-In-The-Money Options) have lowest premium, ATM (At The Money Options) and OTM (Out - Of – Money Options) are basically only premium and has no real value to them.

- There are two reasons for premium – One is volatility and second is Time to expiry.

- The Option seller are selling the options for two reasons – technically there is only one chance in four that at the end of the expiry that he will have to pay up. (more of it a little later)

That would imply that as the time passes and we near expiry the options premium will reduce and eventually become nil – if the option does not go in money till then you are technically dead especially the options that are at the money or in money.(money invested is now zero – other words you have lost your investment).

If we know all of the above then why do we buy ATM or OTM? I will tell you why – as I said earlier we are misers when it come to investments. Let me tell you how with help of an example. Let us say that I am bearish for the near term. So what will I buy – Puts ofcourse.

- Let me go a step further and see the pricing. Uhhh!!! Let us see – the market at 3620 on Friday so – DITM 4200 PUT for the month of May costs me 605/- Rs – I will have to pay Rs 605 X 50 = Rs 30,250/- Now that is a lot of money.

- I will buy ATM (ATM can be taken as +/- 1% of the current price). So let us see 3600 Put for the month of May. That’s Rs 159/- (almost half the amount I would spend on DITM)

- Better still let us see OTM – after all I expect the markets to let us say drop to 3200 – so how about 3200 put? Brilliant! just Rs 43/-

WOW ! that’s what life is all about 3200 Put for 43 costs me 43 X 50 = Rs 2,150/- -- and can you believe it that this idiot – Cheema does not want me to enter this trade? After all what do I loose? 2 thousand bucks for a chance to make what – unlimited amount – after all the reason to buy options are to make unlimited money with risking just 2 thousand.

Convinced that you prefer to buy a OTM for 2,150/-? Well now hear me out to tell you why you are a looser. Okay the principle on which you are betting is limited downside and unlimited upside. Why is the seller selling this when he knows that the profits are maximum of 2,150 and losses unlimited? Well you know why all the insurance companies are having a ball of a time – after all he takes just a thousand bucks and insures you for 1 lakh! Its because of law of probabilities – he knows by statics that if he insures 10,000/- people he will be giving out money to perhaps 1 or 2 people only. If he finds that you are now of 40 Plus age – he will increase the premium and so on and so forth. Ultimately they are making a killing selling us one thousand a year policies and we are doing what – just loosing one thousand every year – Got it?

Similarly a option seller know that the chances of you taking something from him are bleak as hell. Let us see why

- In the first scenario market does not go in our favour. It goes up (like it did for millions of aspirations last month) you will loose your 2,150/-

- second scenario it remains more or less here only – like it generally does when it is in a non trending mode. Once again you loose 2,150/-

- Third scenario It drops – Thank GOD! No? Let’s see: -

- It drops to 3,200 and the series expire. I loose Rs 2,150/-

- It drops to 3,167/- ( I just recover the money I paid (Rs 43 Premium)

- Market goes to 3,100/- Thank GOD I have made money let me get out of the markets fast.

-

At this moment I will introduce you to a term called Delta it is one of the Greek terminology that is used in Options to convey a mathematical end. It is generally represented in form of a fraction starting from 0.000 to 1.000. I want to dwell on this in detail. It is a representation in percentage as to how much your Option will move for a unit move in the price of the underlying. for example my 4200 put has a Delta of 0.846 – that means in simple language that for every one point move of underlying asset the option pricing will move 84.6%. if nifty drops by 100 points the Put will gain by 84.6 Points. The 3600 Put has a Delta of 0.448 or in other words will move 44.8% of the move of nifty. The 3200 Put has a delta of 0.159 – means that the option price will move 15.9% of the underlying.

Two important things – Delta changes as the market moves. Delta of OTM and ATM will contimue reducing as the expiry comes nearer. DITM have higher deltas and ATM and OTM have low deltas. Eventually if the options do not come in money – they will expire worthless. This is the reason where in you find the market going in your direction and still the options not moving at all and your disgustion, desperation, hope and fear increases as the days pass by.

Then what the hell should I do? Well to my mind three things…

- Have a entry and exit strategy if you have to buy options. That means that you should do technicals, fundamentals or something to get the trend right.

- After you are certain of the trend then you buy a DITM Option. It will give you most bang for your buck. Like in the example above – If the markets move 100 point in my favour I gain 85% odd of the move.

- As the market moves more and more in my favour Delta will keep increasing to as much as 100% where I get one point for one point move of underlying.

Now let us see 1. Market moves in the direction I thought it will – I gain. 2. Market does not move I loose just 25 points (almost half of OTM). 3. Markets move in opposite direction – Ideally I should have an exit policy or should hedge my position.

Just give it a cool thought – though technically you can make unlimited money on this Put of yours have I really made a killing? Now think over it what were and are your chances of making money buy OTM or ATM? chances are indeed bleak – but still it is so strongly imbedded in your head – limited risk and unlimited upside that you hope against hope and keep giving small amounts of money to strike it rich one of the days. Believe me it is a pure gamble – as it is buying options – of the three reasons I listed in beginning is speculation and I am sure you will think hard before someone give you a call – 2800 June call is just for 50 bucks – buy me 1 lot because you feel you will just loose 500? Hope I have conveyed my point… And if you still insist that you have to buy cheap ATM or OTM options then as soon as they give you a return pocket the profit. Do not let the decay kick in and eat your profits – other than we are strongly trending in your favour – but unfortunately the chances are indeed low.

One last thing – I would have loved to discuss another Greek for options called Theta – Please do a google and I am sure you will find the definition easy to understand. And as to how you can get to know all these values – go to site called http://samoasky.com and download OptionsOracle – it is a must have software and it supports Indian stocks – just change to NSE India.

Please feel free to comment – I will eagerly look forward to the response and plan the next session if required on options depending upon what you desire.

Hedging headaches… Options strategy 3

Frankly I lost heavily in Jan 08. It was one of those times when the circumstances perhaps conspired against me and million of other retail investors and we held on to our hopes (read futures) – at every stage daring them to go further down, at every downturn we hoped that the markets will recover. That was the time when I did not study stocks and futures and was there because there was perhaps – everyone else doing it. What a crash it was – it was a Tasmania that took along with it millions of dreams. Where did we go wrong? We went wrong in trying to fight the tidal wave that was of a far superior creation than what our thoughts will be. And we were not hedged. Thinking back today I want to roll back the clock that never will and here I am with the most costly lesson of my entire life. Hedging Futures.

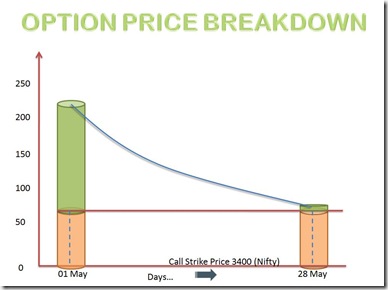

Before I start I let us understand some things. If I buy a option then there the option is priced on some formula and we in India follow the pricing based on Black-Scholes model. You can do a google for that term but beyond this I do not need to explain this term. There after coming to the price of the option - it has some points that I intend explaining. Let me take for example today the Nifty closed at 3470. The 3400 call option costs me Rs 220/-. Let us now break it down. Ideally the 3400 option today should have been Rs 70/-, but it is not so as there is a premium demanded on the option. The premium demanded is = 3470 – 3400 = 70. 220 – 70 = 150. Since the Nifty is traded in lots of 50 – the money that is demanded for the premium is Rs 150 X 50 = 7500/-. Remember that this is the money I am betting to loose for taking or let us say hedging a position. WOW –

Now I am paying in this case Rs 150/- as a premium because there are 30+ days to expiry. As the expiry comes closer – the premium will decay. The decay goes something like this. So If we have the market ending the month at exactly the same place as it is today then no one can take the real value from you – and the premium will decay to near worthless. If you have understood this then we will now workout our strategy wherein we risk the premium only for hedging.

Now have your mind clear whether we are likely to trend up or trend down. This strategy works best in trending markets. Let us say I am bearish about the markets (like I am now a days) I would like to sell a nifty future. So I sell May Nifty future

Let us now see what happens in all the three scenarios – Markets falling (as I expected), Markets remaining range bound (Aka ending at the same point) and markets rising (What I did not expect).

- First Scenario: Markets falls – Let us assume the market falls by 100 points Nifty.

- Market at 3370.

- Future falls 100 points – I get 100 X 50 = Rs 5,000/- credit in my account.

- The option priced at Rs 110/- - option looses Rs 5,500/-

- Market falls another 100 points

- Market at 3270

- Future falls 100 points – I get 100 X 50 = 5,000/- (Plus 5,000/-) a total of 10,000/- in my account.

- Option priced now at Rs 40/- - option looses 180 points = 180 X 50 = 9,000/- ( Real gain starts now) gain = 10,000/-(gained over two days) + 40 X 50 (Option is still worth 40 Points) = 2,000/- minus 9,000/- a total gain of Rs 3,000/-

-

- Beyond this point I will gain almost a 50 Rupees for every point of drop in Nifty. So max gains – take an example of the month of April where the markets moved 900 points – gains will be 900 X 50 = 45,000 minus 11,000/- (Price of the option) = 34,000/-. So gains are unlimited.

-

- Second Scenario: Month expires at 3470 -

- As the time passes by and we come closer to the end of the month – the decay of the option premium will set in and real value cannot go anywhere whereas the decay will eat the 150 point premium we had given that is a max loss of Rs 7,500/-

-

- Third Scenario: Markets Rise – Let us assume 100 points.

- Market at 3570.

- Future rises by 100 points – my account debited by 100 X 50 = Rs 5,000/-

- Option priced 310 (rises by 90 points) so I am plus 4,500/- in options

- Total loss Rs 500/-

- Market Rise another 400 points

- Markets at 3970

- Future rises by 400 points – my account debited by 400 X 400 = Rs 20,000/-

- Option priced 650 (rises by 340 points) so I am plus by Rs 17,000/-

-

- In all the max I will loose is the premium I paid for the Call that is Rs 7,500/-

-

Actually a lot of people would be sh*t scared seeing the 7,500/- figure I am showing as a loss. Remember that it is the maximum in the worst possible case wherein either the market has run away 900 points against you or you wait with the markets not moving anywhere for 30 odd days. Remember that there are ways and means to still keep the losses in a check. So before I come to the solutions and discuss the solutions I will like to present some more problems that you should keep in mind. Problems and how to over come them. Please remember that these are suggestions and there you can be more creative than possibly I can ever be.

First is that we have seen that the premium of the options is more if the time to expiry is more. The premium is not a sine or a cosine curve like it is represented on the chart. However there are some thing you can definitely keep in mind.

- The premium is very high when you take the next month or the following months options so I advice stick to the near month for options.

- The premium gets lowered the deeper IN MONEY the option is. For the above example had I bought 3300 call – on the face of it it would have seemed expensive but if I take out the pure premium – the premium would have been less and so for 3200 strike will be even lesser and so on. Real example the 3300 call is at 280 so premium is 3470 minus 3300 = 170. 280 minus 170 = 110. So just 110 points premium against 150 point premium of 3400 call.

- The out of money option is pure premium and that is a sure loss. The loss will build up till the option comes in money and tries to beat the loss for point per point.

- An example market at 3370 – I sell future. I buy a call of 3600 strike for 110 points. Market go against me – rises by 100 points – I loose 5,000/- and call rises by 35 odd points – yes it is around 30% of move but as the option is not is money – It will not move close to point for point loss I will make in Futures.

-

- The deep in money and out of money options tend to become illiquid. Except for Nifty and a handful of stocks – this statement is true so you will have to take the route to exercise the option if you are deep in money for such stock options hedges.

- The premium drops to low in the last few days (10 odd) to expiry and for a very small premium you can take good positions. The premium in last 10 days to nifty dropped to 40 points. – That is a risk of 2,000/- for hedging a position.

- As far as the futures are concerned the money comes in or goes out everyday so have adequate margin available if the markets are to go against you. For options the money is paid initially only.

Now for some clarification. Even if the markets go against you or your taken position – how many days will you take to realise your mistake? One/Two or Three days? well there would be negligible money lost to the decay factor of the option if you do decide to call quits soon enough. If you do come in this situation. Come out of the market and decide another entry point. Finally I will suggest you one thing – when you do come out - come out of both the positions. If you close one position and leave the other open then the game is as good or bad as playing unhedged. Mind you – in unpredictable times you will never come out of the markets with a headache if you follow this principle and that is what I can promise. Secondly there is nothing really in the markets that will give you returns like a Future will do in the markets.

Options Lesson No 2….

Since the time I have started studying options I have become more and more impressed at them as investment tools of all seasons. Today I will discuss a strategy that I hope to put forward in layman’s words so that everyone understands it and can successfully implement it as far as possible.

The strategy is named Vertical Option Spread. Let us see who would like to use this strategy – I will be used by anyone who has had a loosing streak – anyone who takes whatever position and the market seems to be poised against him/her. Next is when can we use this strategy? Well this can be used when we are trending up, trending down or not trending. I am sure that you would have got it right. well it is true that you can use this strategy in – well almost all situations. The point still remains that you have to make sane decisions based on – let us say technicals. How much effort do I have to put in to make it work? Well if you are a habitual trader then you will be surprised how little time you have to put in. You have to study entry points then put in money and then wait for the eggs to hatch and that is about all. Then what is the catch? Well the catch is that firstly the gains are – depending upon strategy just about 8% to 15% and they are capped. Means that you will not make more than this in the best case scenario. Any other catch? well your losses are also capped at some points above the gains – but the good thing is that chances of your loosing are – let us say 20% or 25% of the times. Each strategy to give you money would take one expiry. So let us say we used this strategy and worked on the probabilities – then we have a good chance to get somewhere near 50-60% returns annually. Now if you are convinced that you need to know it then please continue reading ahead…

What I will do is that I will now explain the strategy first and then see the other aspects.

A options strategy for those who dare…

Okay guys and gals here goes the story. They say that buying stocks is the trend of the yesteryears. If you are in markets then you have to be in futures and options. I agree and disagree at the same breath. Well the reasoning is very simple. Yes you do make tons of money but then you also loose tons of money. If you are not purely mechanical (I am having a lot of difficulty issue in this respect) then it is very easy to come out of the fight not only bruised but with nothing in the pockets. Infact so much so that at the end of the day you can be without a penny – all the hard saving gone down the drain. But if you are those mechanical types who do not believe in hunches/TA or fundamental analysis then you will make pure sweet green bucks by playing in futures and options. I will throw open a options strategy today (as a study example) with reasoning the whole way through at every little step – so if you are a brave heart and do wanna have some fun – read on and jump in. Please do understand the profits are yours and so are the losses – for me it will remain a study only.

In the first step we will choose a underlying stock or index. So here it goes. (The excel sheet with all data is attached)

- I opened the page of NSE-India and scanned through the beta values of the Nifty stocks there. Then I saw and set aside only the stock whose Beta value was more than 1. (You can reach the NSE- Site referred too by Clicking Me) The result was a list of 21 stocks who seem to move with or more than Nifty.

- Then I went to the option chain page in NSE and tried to gauge the liquidity of the options of the above 21 scrips. With this step I was left with eight stock options that I consider were liquid enough for us to take positions.

- Then I went on to see the Average True range of the six stocks I have short listed.

- After that I jotted down the present price of the stock and saw what the ATR meant in terms of percentage of move relative to the stock.

- After this I again go back to the options chain and see the listing of the options (call/puts). I compare this with the spacing of options. Here surprisingly there was no in money put available for Tata steel.

- Next step was to pick up any one of these stocks and concentrate on them for buying a strategy. I will give example with one only and that is Reliance.

- Next was a pain staking step where I calculated the premium, the cost I will pay for the strategy etc.

Well this is pretty much end of the statistics that I want and now what I do next is really what my mind would say so. Ofcourse I do also have a look at the rest of the technicals. What I really expect at this moment is a 50% retracement to the present run up but all the same will want the positions to be well hedged. So keeping the positions I would go in for some straddle / strangle that likely to give me good gains. Remember also that we are in the middle of the month and the decay will kick in fast and hard.

Now again not too much reasoning I can give as to why I have taken the positions but I chose Apr 1740 call and Apr 1800 Put. Firstly the premium is pretty much the minimum and I might have loved to go to 1830 put but the position is illiquid so premium is very high.

Now the brasstracks: -

- For these positions I will have to pay a total of Rs 54,705/-

- the strategy pays off below the Rs 1,651/- or above Rs 1,895/-

- Maximum loss (cost call plus cost put minus 60 multiplied by 300) that is equivalent to 36,705/- and maximum gains unlimited.

- Days to expiry… 12 trading says.

- So basically this strategy is trying to make use of directional volatility of more than 122 Rs in any one direction.

With the increase in lot size in most cases the investment has considerably increased. The best for anyone with less than this amount is Nifty.

Do post your comments so that we all can learn and improve upon such investment ideas. The options file that I have been talking about is uploaded to skydrive – please click the link to download it. Options Excel file